Professional Services

Whether your challenge can be solved by our existing products or requires the development of new analytics solutions and market design approaches, our team is ready to help.

Electricity price volatility: How to trust AI-based forecasts

.png)

Electricity prices in Europe (and around the world) are increasing due to various global factors, mainly driven by natural gas prices.

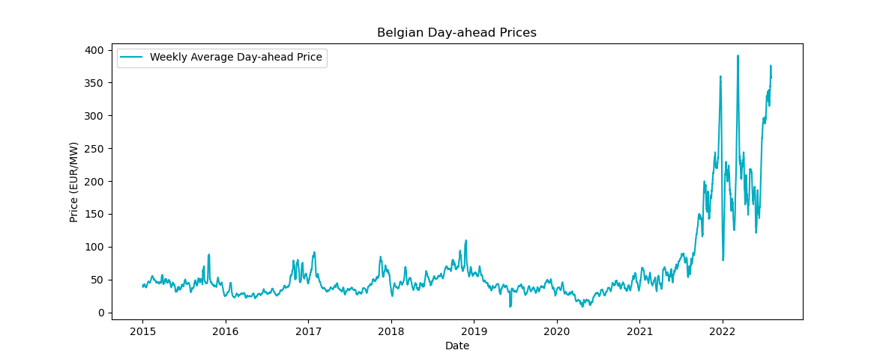

Prices aren’t just going up — they’re also becoming much more volatile in the short term. For example, take a look at this chart of day-ahead electricity prices in Belgium:

To act confidently amidst this volatility, electricity generators and producers, flexible asset owners, traders, and retailers are looking for newer, more innovative electricity price forecasting solutions.

Forecasting solutions that only focus on accuracy (i.e. minimizing errors) are no longer sufficient. Market participants are now looking for AI-powered solutions that provide probabilities and confidence intervals to help them make the best decisions.

At N-SIDE, we’ve developed short-term electricity price forecasts in several markets. These machine learning algorithms are well suited to helping market participants combat volatility. We recently recorded a webinar explaining how the algorithm works.

In this article, we’ll summarize how AI solutions can help you increase the value of your short-term market portfolio with confidence.

Existing price forecasting models struggle with volatility

The price volatility of the last few months has exposed weaknesses in existing forecasting solutions, including those powered by machine learning.

Traditional machine learning algorithms were trained for an entirely different energy market with far less short-term volatility than what we’re seeing today. To get more accurate results that are easily interpretable by experts, we need a mixed approach that injects more knowledge into AI models.

What’s required for a successful AI forecasting model?

There are five ingredients in a successful model that can stand up to increased volatility in short-term electricity prices. Here, we’ll cover each at a high level — check out the webinar for more details.

1. Choosing the right technology to balance complexity and significance

To solve the problems related to short-term electricity price forecasting, N-SIDE uses machine learning techniques such as additive regression trees, random forests, and boosting. We carefully choose technologies that enable us to achieve accurate forecasts without sacrificing transparency.

2. Controlling the forecast uncertainty to reduce your risk

Short-term electricity prices are following a non-normal distribution. N-SIDE algorithms adjust for this by not making assumptions about the distribution of residuals nor normality of the data.

As an output, we provide forecasted prices, probability, and confidence intervals — all the tools market participants need to make informed decisions.

3. Providing transparency by extracting the input drivers

When the reasoning behind AI algorithms is not transparent to users or stakeholders, you get the black box effect. This is of particular concern in the energy sector, where algorithms are used to make crucial decisions with significant financial implications.

To ensure that our algorithms are explainable, we developed multipole expansion, a unique method that enables us — and our users — to understand the input drivers of the forecast.

4. Fitting the model objective to the business purpose

Algorithms need to ask the right questions (i.e. use the most relevant objective function and input features for each use case) in order to produce accurate, actionable outputs.

The N-SIDE Energy Forecasting Platform leverages more than 500 data sources to gather relevant inputs, including fundamentals data (consumption, generation mix, renewable generation, weather data, etc.) and direct market information.

5. Ensuring high reactivity to capture the latest market changes

In the dynamic energy industry, market changes are inevitable, and algorithms need to keep up.

Amidst increased volatility, new regulations, and news systems (such as MARI) going live, sticking with the same model will produce less-than-accurate results. N-SIDE's models are continually retrained to adjust to market changes using supervised learning.

What are the real-world impacts of AI-powered forecasts?

When it comes to electricity price forecasting, machine learning can solve some of the challenges associated with volatility. But how does this impact profit and loss in the real world?

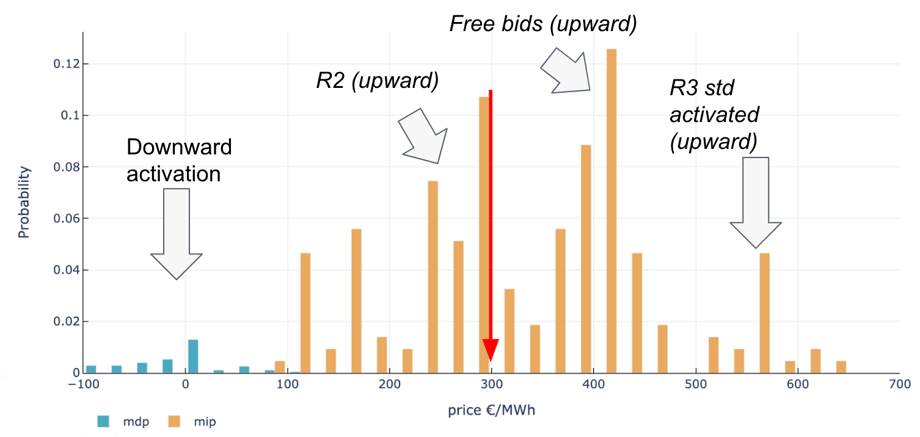

In the webinar, we review detailed outputs of a specific forecast example: short-term imbalance prices in Belgium.

Using this forecast, the market participant is able to anticipate high imbalance prices and evaluate the opportunity for profit. For every 15-minute interval, the algorithm provides a range of forecasts as well as the probability of each forecast:

Using the latest known imbalance price as a benchmark, we measured the impact of this strategy on net savings. We found that our algorithm performed about three times better than the benchmark, for a savings increase of about 200%.

About the Author

With a background in Business Engineering and exposure to various advanced analytics start-ups, Michael is passionate about the energy sector and the development of innovative solutions to accelerate the energy transition. After putting a strong focus on the development of N-SIDE Energy activities towards different types of actors, he now has specific expertise in energy forecasting solutions for market participants. Michael now leads the Energy Forecasting Platform team at N-SIDE.

Michael Malcorps

Case Study

N-SIDE makes pan-European, single-day-ahead coupling possible with EUPHEMIA

In this case study, we detail the history, inner workings, and results of the PCR EUPHEMIA algorithm, which is used by 26 countries across Europe.

Read more

News

Indian electricity prices determined with innovative Belgian technology

India’s premier Power Exchange IEX partners with N-SIDE to implement its Power Matching Algorithm for price discovery in its Day-Ahead Market

Read More

Brochure

Power Matching Algorithm for power exchanges

Optimize your energy and capacity markets by matching supply and demand in closed-gate auctions. N-SIDE’s Power Matching Algorithm for power exchanges is an auction optimization algorithm that can be integrated within new or existing energy market operations.

Download Now