Professional Services

Whether your challenge can be solved by our existing products or requires the development of new analytics solutions and market design approaches, our team is ready to help.

Can AI support your intraday energy arbitrage strategy?

European intraday energy markets have become more interconnected, more liquid, and more volatile in recent years. These trends have introduced new risk into intraday arbitrage strategies — but they also represent opportunities for savvy traders.

At N-SIDE, we’ve responded to these trends by developing new technology to help market participants maximize the value of their intraday energy market arbitrage strategies.

Our machine learning algorithms are able to forecast intraday energy prices in specific markets (as well as the spread between different markets) to identify possible arbitrage strategies and provide recommendations that help inform trading decisions.

We recently hosted a webinar on this topic. You can watch the complete replay here.

In this article, we’ll answer one of the most important questions in this field:

Can AI and machine learning really be used to support a trading strategy in intraday energy markets?

Challenges to using AI in intraday energy arbitrage

Predicting how energy prices will fluctuate hour by hour has always been challenging. Now, with increased volatility caused by renewables and other factors, it’s harder than ever.

Electricity prices are dependent on a wide variety of factors, including:

- Load

- Temperature

- Renewable generation

- Technical price indicators

- Market prices

- Periodic factors (e.g., time of day, week, year)

Machine learning technology is ideally suited for generating forecasts based on large and complex inputs. But in order to produce a useful and accurate forecast, it’s critical that the machine learning algorithm uses the correct objective function, uses the correct input features, and is available in a usable product.

In addition, it’s important that the algorithm is transparent, so the user can understand how predictions were made and the main drivers of the predicted value.

How AI intraday energy arbitrage forecasting works

At N-SIDE, we leveraged deep expertise in both advanced mathematical modeling and the global energy industry to develop our Energy Forecasting Platform, which is capable of forecasting many short-term markets (including intraday arbitrage).

Here’s how we overcame the major challenges to intraday energy market forecasting:

Choosing the correct objective function

In the field of machine learning, “objective function” refers to the value you’re trying to maximize or minimize with your algorithm.

In many forecasting applications, the objective is to simply achieve the most accurate forecast (i.e. the objective function is to minimize the divergence between the forecast and reality). However, when it comes to arbitrage, accuracy in some ranges is more important than others.

While there are many possible values in the forecast, for the trader, there are only three strategic outcomes. Should they buy, sell, or hold?

In intraday power market forecasting, the requirement is a trinary output.

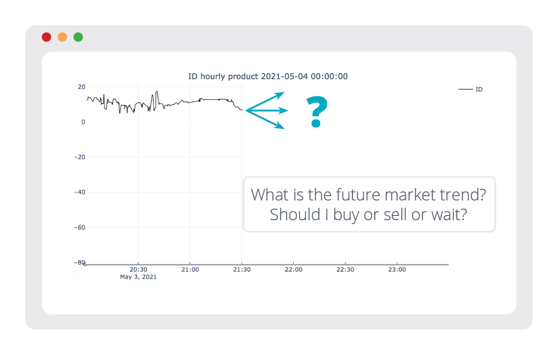

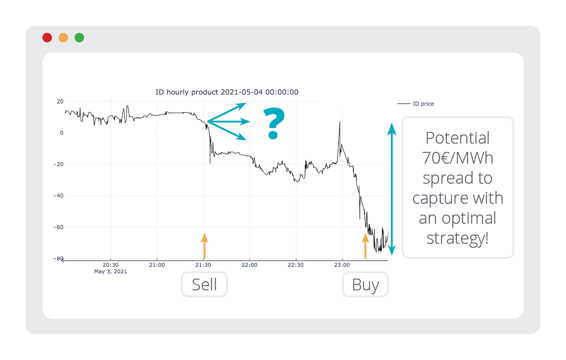

These examples show the electricity price on the German intraday market for a given day in May 2021. As you can see, if the algorithm could predict the trend of the market with reasonable confidence, you could generate a lot of additional revenue!

Example of real electricity prices on the German intraday market.

Because the output is trinary (buy, sell, or hold), the objective of the algorithm is not to provide the most accurate forecast in all cases. What’s more important is that we’re optimizing the profit made by the strategy, which is directly related to the direction provided by the algorithm. Will the market go up, down, or stay the same?

With this as the objective function, the trader will be able to confidently use the recommended strategy to maximize their profit.

Using the correct input features

As discussed, many factors influence intraday energy prices. Using our industry expertise, we were able to select the input features we believed were most likely to impact the forecast, then test our assumptions as the model was trained.

N-SIDE’s German intraday energy market forecast uses a variety of input features, including:

- Fundamentals (supply and demand quantities such as consumption, production, residual load, and trend)

- Market-related information (e.g., latest intraday prices in this market and neighboring markets, price trends)

- Technical indicators (understanding and preprocessing indicators such as moving average, RSI, MACD, resampling, and combination)

Building a usable product

Developing and training a machine learning algorithm is one thing — providing real-time arbitrage strategy recommendations is another.

At N-SIDE, we have deep experience in user-friendly software development. Our energy forecasting application is available via a web server or REST API, so you can easily integrate its insights into your existing workflows.

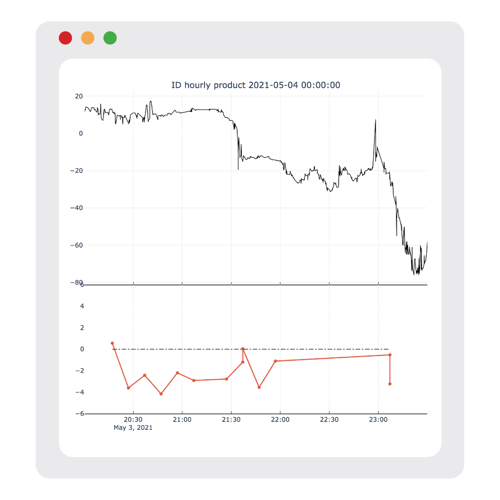

An example of an N-SIDE forecast (below) compared with the real data (above)

Ensuring transparency of the machine learning algorithm

How were we able to validate our assumptions about which inputs are influencing the forecast?

Some machine learning applications suffer from a black-box effect — meaning it's impossible for the user to understand how inputs and outputs are related.

At N-SIDE, we believe it’s critical that AI algorithms are transparent, especially when they have significant financial implications (as in this example). To see inside the black box, we developed a technique called multipole expansion. You can learn more about multipole expansion in this article:

Related: How to avoid the AI black box in energy time-series forecasting

About the Author

With a background in Business Engineering and exposure to various advanced analytics start-ups, Michael is passionate about the energy sector and the development of innovative solutions to accelerate the energy transition. After putting a strong focus on the development of N-SIDE Energy activities towards different types of actors, he now has specific expertise in energy forecasting solutions for market participants. Michael now leads the Energy Forecasting Platform team at N-SIDE.

Michael Malcorps

Artificial inteligence

How to avoid the AI black box in energy time-series forecasting

Artificial intelligence (AI) is playing a growing role in the day-to-day operations of critical industries. Today, machine learning algorithms are used to screen...

Read more

Webinar

Short-term electricity prices: How AI can help you build confidence in the current market volatility

Your forecast is precise. But can you trust it? Add confidence level to your forecasting using AI

View Webinar

Blog

“Imbalance Risk Forecast”: an innovative approach to solve short-term market arbitrage problems, running on N-SIDE Energy Forecasting Platform

Ever wondered if artificial intelligence could support you fully in your arbitrage between day-ahead and imbalance markets? N-SIDE has developed over the years...

Read more