Professional Services

Whether your challenge can be solved by our existing products or requires the development of new analytics solutions and market design approaches, our team is ready to help.

N-SIDE Energy Forecasting Reacting to Market Changes

Giancarlo Marzano

Giancarlo Marzano

Turn threatening market volatility into a profitable revenue stream

At N-SIDE, we solve complex societal challenges by using solutions based on advanced analytics and artificial intelligence to unlock the value of data and empower the end user to make better decisions. But sometimes these issues are marked by a lot of uncertainty, and the best way to deal with them is to use historical data and information along with a deep understanding of the problem's underlying principles.

How can energy forecasting bring value to you during highly uncertain times

The Energy Forecasting Platform, which was made by N-SIDE and is based on a proprietary tree-based algorithm, is a good example of this kind of situation. In recent years, the news has been filled with pieces seeking to shed light on the difficult predicament that the energy markets are in. The complex geopolitical situation, combined with the ongoing integration of renewable energy sources and the limited availability of resources, are some of the factors yielding to an unprecedented volatility observed in the main marketplaces. Along with the ongoing process of balancing markets across Europe, these effects must be taken into account.

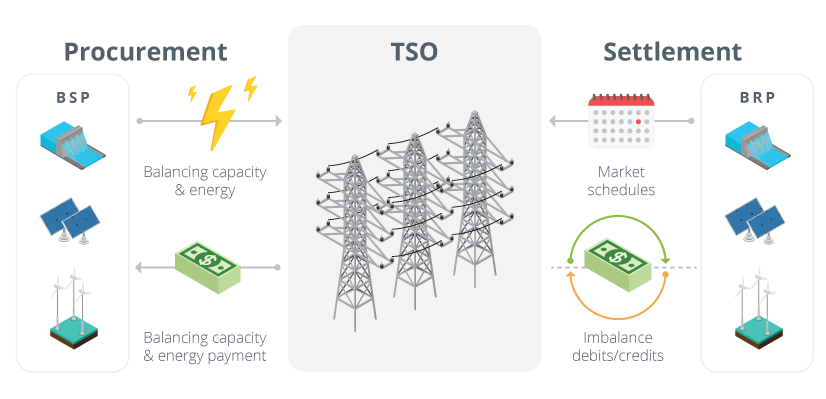

Secondary and Tertiary reserves (R2 and R3) are going to be procured through new European Balancing platforms, PICASSO and MARI respectively. This integration will allow National Transmission System Operators (TSOs) participating in the program to source balancing power from Balancing Service Providers (BSPs) all around Europe, and not necessarily in the same geographic region of the TSO itself. As a consequence, balancing prices are expected to represent the European balancing situation rather than the national (or local) level. Furthermore, total imbalance positions will improve due to increased liquidity through the platform.

At N-SIDE we have extensive expertise in the field of energy balancing markets, and we can use this knowledge to build our models so that they can respond quickly to structural changes in the market, making up for the lack of historical data.

The use case which will be used to illustrate this approach, is the forecast of the imbalance price which the Balancing Responsible Parties (BRPs) are exposed to when deviating from their declared position. These actors are responsible to submit market schedules to TSOs, and then the TSO needs to ensure the balance of the system in real time. This balancing is performed thanks to the support of Balancing Service Providers (BSPs) active in ancillary services, and the deviation of the BRPs are to be computed a-posteriori. Depending on the direction of the deviation (demanding/injecting more or less electricity) and the network status (Long or Short), the BRPs are either compensated or requested to perform a payment to the TSO. As a consequence, it is relevant for such actors to be able to forecast the imbalance price they will be exposed to in order to better manage their assets.

By forecasting each term of the imbalance price formation, rather than just focusing on the final output value, our algorithm is able to achieve up to 10% more accurate results than state-of-the-art. Furthermore, the results are more transparent and additional insights (e.g. such as the individual contribution of the various features to the estimated result) can be gathered from the model.

Our unique approach, applied to the German Scenario

To take a specific example, let’s analyse the effect of the rollout of PICASSO in Germany. The platform went live in the country on June 22nd, 2022. There are four (4) different TSOs in Germany, each with their own control zone, and the imbalance price is computed in a uniform manner considering these four areas. This uniform imbalance price is known as reBAP.

To compute the reBAP, there are a series of steps to be considered. First of all, the net cost of procuring balancing power is computed on a 15 minutes basis, by subtracting the revenues obtained from MARI and PICASSO from their associated costs. This net cost is divided by the net balance position across the German Control Center, to obtain the first imbalance price indication. This value is then capped at the largest price attained in the interval by MARI or PICASSO, to avoid high prices occurring due to moments of extremely small net balance positions.

Consequently, an additional price cap is used for scenarios where the balancing energy is between -125 MWh and 125 MWh, which scales linearly the final price using the EPEX spot IntraDay price. This result is then adjusted considering an incentive component aimed at reduction of strategic imbalance participation (e.g. voluntarily deviate from declared market schedule to gain a profit) and a scarcity component triggered only when more than 80% of the dimensioned reserves (R2 and R3) have been activated. This process yields the final price which BRPs are exposed to.

By applying this logic into our Energy Forecasting Platform, we can now highlight the impact of each factor that affects the formation of imbalance prices, make up for the lack of data caused by structural changes in the market, and improve the accuracy of the forecasted output. Hence, market actors can manage their position with more confidence, even when there is a lot of uncertainty, as it is observed in the European energy landscapes right now.

About the Author

Giancarlo holds a double master's degree in Smart Electrical Networks and Systems from KTH (Sweden) and INP Grenoble (France) with a specialization in Electricity Markets and Smart Grids. He has 5 years of experience, starting in the Energy Storage Industry, on topics related to battery storage integration and their participation in grid balancing and wholesale energy markets. Since 2021 he works at N-SIDE where he tackled various topics such as Grid Flexibility, Local Electricity Markets and Power System operations. Giancarlo is responsible for leading the account management activities of N-SIDE's Energy for System Operators and Regional Coordination Centers.

Giancarlo Marzano

SOLUTIONS

Reduce your risks and make optimal decisions

N-SIDE helps buyers and sellers anticipate the price dynamics of short-term electricity markets using machine learning-based forecasting tools.

Short-term electricity markets are increasingly volatile due to uncertainty around the supply-demand equilibrium. If properly anticipated, this increased volatility can be converted into additional revenue streams.

Read more

Webinar

Get an insider view from people who craft power market auctions every day

Learn from the very people who are responsible for shaping the power market auctions every day.

This webinar will help you will better understand how market clearing algorithms such as those used for the European day-ahead market (EUPHEMIA) and other power markets work.

WATCH NOW

BLOG

Electricity price volatility: How to trust AI-based forecasts

Electricity prices in Europe (and around the world) are increasing due to various global factors, mainly driven by natural gas prices.

Prices aren’t just going up — they’re also becoming much more volatile in the short term.