Professional Services

Whether your challenge can be solved by our existing products or requires the development of new analytics solutions and market design approaches, our team is ready to help.

Power Market Auctions 101: Explaining the EU Electricity Market

Marcelo Torres

Marcelo Torres

All over the world, power markets have been put in the spotlight. Despite a substantial correction, electricity prices remain high and volatile. In reaction, policymakers are questioning current market structures. This is especially true in Europe, where the European Commission has launched a review of the market design with the aim of reducing price volatility and making the market more resilient.

At N-SIDE, we help system operators, power exchanges, and market participants navigate challenges like those we are currently facing.

With all eyes on power markets, we decided to launch a new webinar series to educate our community on the dynamics at play. The first webinar, Power Market Auctions 101, is available to watch here.

In this article, you'll find some of the key points from the webinar. Be sure to watch the video replay for a more detailed analysis.

Let’s start with the basics:

What is an electricity market?

Like all other commodity markets, an electricity market is a system for trading electricity that is based on prices. These prices are determined by supply and demand.

Markets are one way to allocate electricity to consumers and incentivize producers. They are an alternative to centrally planned approaches to electricity allocation.

In perfect conditions, a market approach will allocate electricity in a manner such that it provides the maximum possible benefit to all participants. In other words, it will set exactly the right price for electricity.

In the real world, economic conditions are never perfect. However, shifting from centrally planned electricity allocation toward a market-based approach has real benefits.

Among the most important benefits are the improved ability to trade between regions (which in turn improves energy security, competition, and liquidity) and better integration of renewable energy generation.

Europe is a case study of the benefits of integrated electricity markets. According to a report from the EU Agency for the Cooperation of Energy Regulators (ACER), these benefits have an economic value of € 34 billion per year.

What makes electricity markets different from other commodity markets?

While electricity markets are similar to other commodity markets, they are also unique in key ways.

The qualities that make electricity markets unique include:

-

Supply is highly variable and difficult to predict. Electricity supply changes dramatically over time, a challenge exacerbated by the growth of variable renewable energy generation technologies such as wind and solar. Demand, while more predictable than supply, also varies depending on the weather.

-

Storage is difficult and expensive in large volumes. Unlike other commodities, you can’t store electricity in a warehouse. While improving, the deployment of long-duration storage technologies isn’t matching the pace of renewable energy penetration in the energy mix.

-

Physical constraints must be obeyed. Energy is transported on a power grid, and that grid has physical limitations such as frequency and voltage stability requirements, as well as thermal limits which complicate the intersection between markets and grids.

-

Supply and demand must be instantaneously and consistently matched. The stability of the grid relies on consumption and production always staying in balance. The three constraints detailed above make this challenging.

-

There are a wide variety of market participants. Compared to other markets, electricity markets must accommodate the needs of more participants with more diverse capabilities and risk appetites.

All of the above qualities make designing an efficient and effective electricity market difficult. So, how is it done?

How do wholesale electricity markets work?

In order to manage all of the challenges described in the previous section, wholesale electricity markets are broken down into several more specific types of markets.

These markets include…

-

Forward electricity markets. Forward markets enable participants to trade electricity from years ahead through the day before delivery. This kind of market helps manage risk and reduce price volatility.

-

Day-ahead electricity markets. As the name implies, these markets are for trading electricity the day before delivery. Day-ahead markets can be used for trading large volumes of electricity and/or refining one’s market position. The utility of day-ahead markets depends on the liquidity of the forward market in that specific region and the risk appetite of market participants.

-

Intraday electricity markets. On the day the electricity will be delivered, trading is still occurring. This allows market participants to refine their positions and react to unexpected changes on the demand or supply side, contributing to the balancing of the power grid.

-

Electricity balancing market. Finally, there is a market for correcting imbalances in real-time. Balancing markets are used to maintain the technical standards of the system and ensure physical constraints are being obeyed.

To make matters more complicated, there are different ways these markets can operate. Forward, day-ahead, and intraday trades can take place on centralized exchanges or in direct over-the-counter (OTC) deals between buyers and sellers.

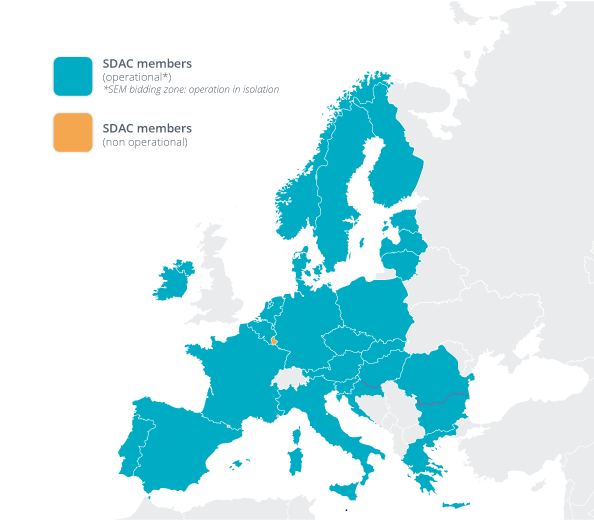

In Europe, OTC and exchange-based trading are complementary and essential for the sake of competition, liquidity, and the overall efficient functioning of wholesale energy markets. Single Day-Ahead Coupling (SDAC) is the most liquid marketplace in Europe, allowing it to serve as a reference price for forward contracts, power purchase agreements, and support schemes (e.g. contracts for difference).

In day-ahead markets, it’s important to pool liquidity (in other words, ensure all producers and consumers have access to the same pool of electricity). To accomplish this, an auction mechanism is used.

What is a power market auction?

A power market auction is a centralized process that enables participants to trade anonymously and determines prices based on supply and demand.

Unlike continuous trading (which, as the name suggests, is used to match buy and sell orders continuously) day-ahead power market auctions take place at a specific time of the day, every day. The bids of buyers and sellers are placed in merit order (from the lowest to the highest priced bid for the sell-side and the opposite for the buy-side). The intersection between demand and supply is found and equilibrium is reached, setting the clearing price.

When multiple buyers and sellers are participating in a power market auction, that auction is usually “pay-as-clear.” Pay-as-clear simply means that all participants will pay or receive the same price, called the clearing price, once it is determined. This is as opposed to “pay-as-bid” auctions, which are more common in auctions with a single central buyer. In these markets, market participants that see their bids accepted, also known as being “in-the-money,” receive the price of their individual bid.

Power market auctions are operated by automated, computerized processes, enabling a large volume of market participants which often have complex requirements to rapidly reach an agreement on a clearing price.

A prominent case is the algorithm used by Power Exchanges across Europe, also known as Nominated Electricity Market Operators (NEMOs) to clear the SDAC market, which is called EUPHEMIA¹.

[¹The EUPHEMIA algorithm is the property of the Power Exchanges in the Price Coupling of Regions (PCR) project.]

EUPHEMIA was developed by N-SIDE, and it solves market-clearing problems containing hundreds of thousands of orders, determining prices and flows between different countries (or more precisely, bidding zones) in less than 17 minutes.

What are the key ingredients of a power market auction?

In order to operate efficiently using an auction mechanism, three economic ingredients must be present in a power market.

These are…

-

Competitive equilibrium. This means that the clearing price is determined by the intersection of supply and demand. In competitive equilibrium, all participants should be satisfied with the determined price.

-

Producer and consumer surpluses. Consumers and producers can each benefit from the differences between their bids and the market clearing price.

-

Social welfare. In economics, this term refers to the sum of the producer and consumer surpluses.

For a more detailed explanation of how each of these three ingredients play out in power markets, including examples, watch the webinar replay.

About the Author

Marcelo is an energy market professional with 10 years of experience in regulatory and commercial roles. He specialises in electricity market design and has been actively involved in the development of the underlying market arrangements to facilitate the integration of renewable energy and enable the deployment of flexibility in Europe. Before joining N-SIDE, Marcelo held several positions in the energy sector, including at Ofgem, where he led the British regulator’s work on cross-border electricity trading arrangements, at Drax Group where he was responsible for market development activities, and at Alpiq as Senior Business Development Manager. He holds a Master’s degree in Ecological Economics and is passionate about developing the future energy markets that will accelerate the transition to Net Zero.

Marcelo Torres

Content you might also like...

Blog

How Do Power Market Auction Algorithms Work?

In this article, we explain in simple terms how market clearing/power matching algorithms work. These algorithms power the world’s electricity markets.

Read more

Webinar

How to make Power Markets ready for the future?

In the final webinar of the series, we take a step back and look into the future. We explore how the energy landscape is evolving and how power markets can be future-proofed

Read more

Case study

N-SIDE makes pan-European, single-day-ahead coupling possible with EUPHEMIA

In this case study, we detail the history, inner workings, and results of the PCR EUPHEMIA algorithm, which is used by 26 countries across Europe.

Read more