Professional Services

Whether your challenge can be solved by our existing products or requires the development of new analytics solutions and market design approaches, our team is ready to help.

How Do Power Market Auction Algorithms Work?

.gif)

Pierre Crucifix

Pierre Crucifix

How can we optimally match electricity production and consumption? In many regions, a market-based approach is used. Many of these power markets rely on an auction mechanism to trade energy in a way that optimizes the social welfare of market participants.

The market around electricity involves a wide range of market participants, many physical constraints, and a highly volatile supply, making it a complex commodity. As a result, power market auctions are very complex and must be operated using computer algorithms.

N-SIDE helps design and develop the algorithms that power the world’s electricity markets. We recently launched a webinar series to educate our community about how these markets work. Click here to read a summary of the first webinar, which covers the basics of power markets and the necessary ingredients of a power market auction.

In this article, we’ll dive deeper into how the algorithms that run power markets work.

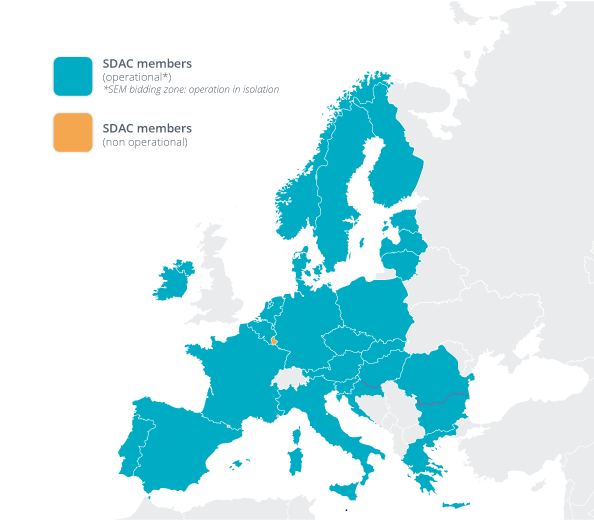

As an example, we’ll look at EUPHEMIA¹, the algorithm developed by N-SIDE which supports Single Day-ahead Coupling (SDAC) in Europe.

[¹The EUPHEMIA algorithm is the property of the Power Exchanges in the Price Coupling of Regions (PCR) project.]

How do modern power market auctions work?

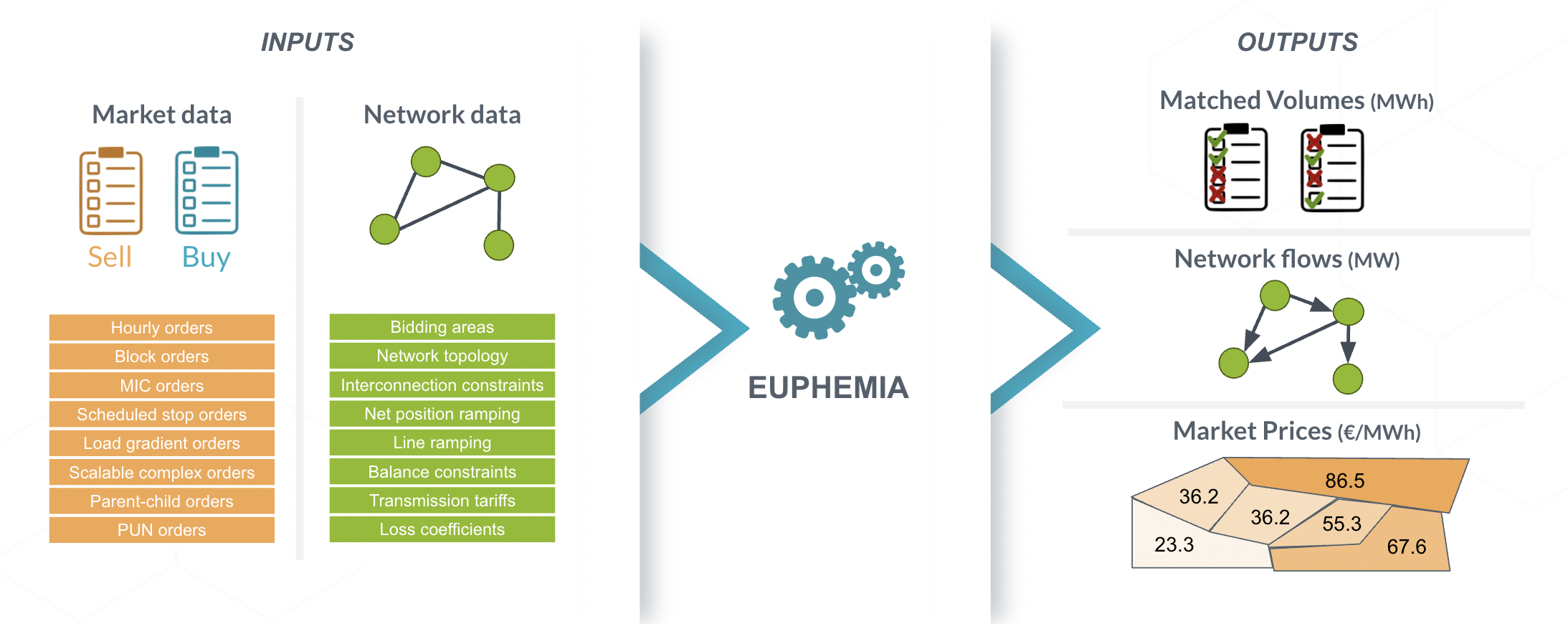

The goal of a power market auction is threefold: to match the volumes of electricity production and consumption, to ensure this electricity can flow from origin to destination without violating network constraints, and to set the optimal price for each unit of electricity.

These outputs can also be expressed as:

- Volume acceptance per order [MWh]

- Commercial network flows [MW]

- Market price per bidding zone [€/MWh]

However, arriving at these outputs is very difficult. Constraints of the network (such as those related to topology, ramping, tariffs, and losses) must be considered. In addition, modern power market auctions must support many different kinds of bids from different participants.

Computer algorithms are used to convert these complex inputs into the outputs described above. The algorithm that supports a power market auction is called a power matching algorithm or market clearing algorithm.

In some large markets, this process leads to hundreds of thousands of trades per day. As a result, the algorithm has to be capable of quickly solving large-scale, complex mathematical problems.

Example: EUPHEMIA for Single Day-ahead Coupling in Europe

In Europe’s Single Day-ahead Market, the specific algorithm used is called EUPHEMIA.

EUPHEMIA couples the electricity markets in 27 countries by processing hundreds of thousands of orders, including thousands of block and complex orders, in under 17 minutes. This case study provides an overview of the history and purpose of EUPHEMIA.

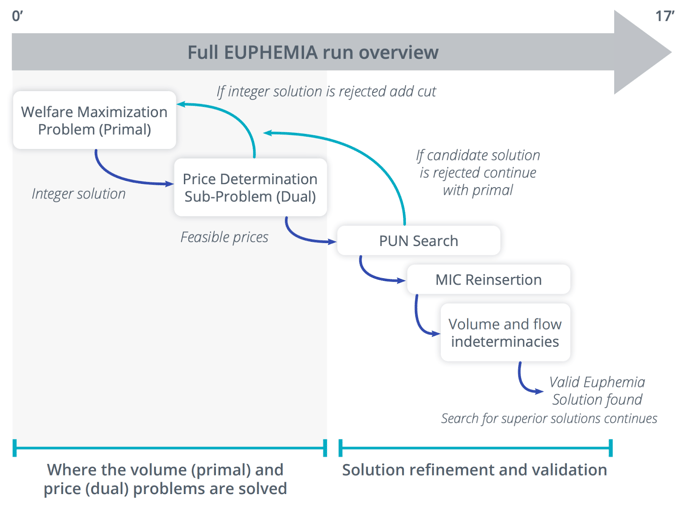

Due to the complexity of the European electricity market, EUPHEMIA has to solve many problems in sequence in order to arrive at solutions which fulfill all requirements of the various order types and resolve indeterminacies in the outcome. This chart is a graphical representation of what happens each day, when EUPHEMIA is started:

For a more detailed explanation of how EUPHEMIA works, watch the on-demand webinar below.

The main design elements of a power market auction

EUPHEMIA is just one example of a power matching algorithm. However, auctions can be used to optimally match supply and demand in many markets and regions.

When designing a power market auction (and the algorithm which operates it), many elements must be considered. These elements fit into three main categories: order types, network representation, and pricing schemes.

Order types

Many orders are simple, involving just four elements: quantity, price, time period, and bidding zone. However, due to the nature of electricity, many power market auctions also have to consider more complex orders.

Examples of such orders include block orders, which involve minimum acceptance ratios (e.g., 80%) due to plant start-up costs. Another order type is parent/child orders, in which the dependent bid cannot be accepted without the bid it depends upon also being accepted. Scalable complex orders are another complex order type, involving a fixed cost to be recovered, minimum acceptance volume per hour, and ramp conditions.

Network representation

How the network is modeled in the computer is another important element of power market auction design. The two main categories of network representation are available transfer capacity (ATC) and flow-based. This article goes into detail about these models and their advantages and disadvantages.

Other network representation elements to consider include loss modeling, ramping between periods, and constraints over sets of lines.

Pricing schemes

Finally, one must also consider how prices are determined when designing an auction. As described in the previous article, the two main approaches in this category are pay-as-clear and pay-as-bid pricing.

Other pricing elements can also impact power market auction design, such as the handling of paradoxically accepted and rejected blocks, zonal pricing, and nodal pricing.

Balancing complexity in market clearing algorithms

Each additional element will increase the complexity of the algorithm, and some will influence it more than others. When designing a power market auction, it’s important to balance the needs of the market with the complexity of the problem.

If the problem is too complex or the algorithm is not sufficiently advanced, it won’t be able to efficiently allocate energy, or won’t be able to do so quickly enough.

Common computational challenges when developing market clearing algorithms include:

- Handling of orders with complex production constraints

- Dealing with tolerances and the downstream impact of rounding errors

- Running all programs and subprograms within a short time limit

For examples of how EUPHEMIA handles each of these computational challenges, check out the full webinar:

About the Author

Pierre is an Engineer and Economist active in market-oriented activities at N-SIDE. He has contributed to some Euphemia R&D achievements and to the deployment of our Power Matching Algorithm in India. He has also worked for system operators by designing and delivering solutions for local and balancing markets. Pierre is now the Product Manager of the N-SIDE Power Matching Algorithm, shaping how our market clearing offer can evolve to allow even more end-consumers worldwide to get access to cheaper and cleaner electricity.

Pierre Crucifix

Content you might also like...

Blog

Power Market Auctions 101: Explaining the EU Electricity Market

Electricity markets are unique among commodity markets. In this article, we’ll explain what electricity markets are and how they work using auction mechanisms.

Read more

Webinar

How to make Power Markets ready for the future?

In the final webinar of the series, we take a step back and look into the future. We explore how the energy landscape is evolving and how power markets can be future-proofed

Read more

Case study

N-SIDE makes pan-European, Single Day-ahead Coupling possible with EUPHEMIA

In this case study, we detail the history, inner workings, and results of the PCR EUPHEMIA algorithm, which is used by 26 countries across Europe.

Read more